Riba in transaction and business. The inaugural issuance of the Worlds first green sukuk in Malaysia has expanded the narrative for the synergy between Islamic finance which values socially responsible investment and the global trends of.

Reality Of Islamic Finance Any Difference Finance Accreditation Agency Faa 1012469 W

The Malaysia Hub since its establishment has partnered with Malaysian counterparts in cementing the countrys global leadership in Islamic finance.

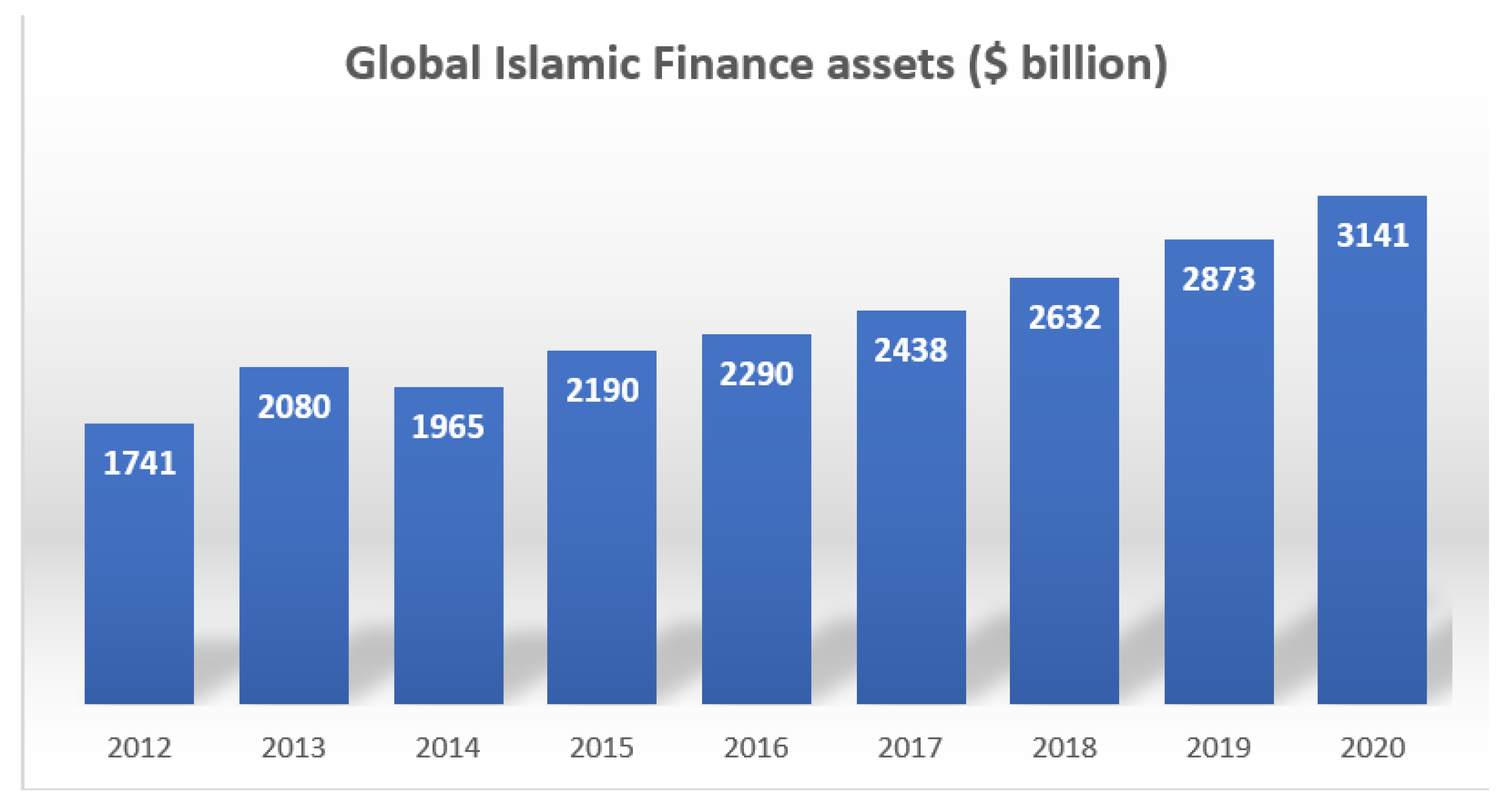

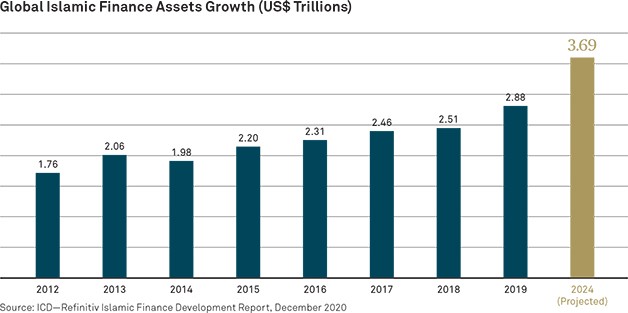

. Arabia Insurance Cooperative Co invites shareholders to vote on proposed capital increase by way of rights issue. However the banks face risks of asset. The Islamic banking and financial services industry showed a rapid growth during the last 10 years having accomplished a milestone reaching a value of more than 2 trillion by 2015.

RESEARCH REPORTS. 1998 has resulted in a dearth of wide-ranging financial. To expose students intellectuals and industrialists issues currently facing Islamic Finance.

This has been further hampered by a lack of trust among different faith communities where Muslims were historically charged higher interest rates by non-Muslim financiers Kuran and Rubin 2018. Islamic funds and Islamic products are widely offered by financial institutions in Malaysia. To provide a comprehensive understanding of.

With the current growth rate of Malaysian Islamic banks the sector would reach a share of 40 percent from the overall banking industry in the country. This important aspect comprises both. This is because Islamic financial system is based real assets and avoiding speculation and riba Mohd Zain et al 2011.

Issues and Challenges Syuhaeda Aeni Binti Mat Ali Rusni Hassan and. A notable example is India which has the third-largest Muslim population in the world but has a negligible non-existent Islamic finance industry. Capital Markets of the Muslim world.

Malaysias rank was similar in the takaful sector for that year but with Saudi Arabia as the leader followed by Iran. This chapter offers a practitioners perspective on how Islamic banks in Malaysia deal with unlawful sources of funds. Based on the same ranking system Malaysia took the lead in other Islamic finance sectors such as financing real estate and financial technology or fintech.

The research discusses current issues in Islamic banking and finance such as homevehicle financing loans and other related contract with reference to the opinions of classical jurists. Law and regulation are becoming increasingly important in any discourse involving the Islamic financial services industry. Through the supports of scholars policy makers and consumers these issues can be resolved over time with Islamic finance literacy.

Fitch expects Pakistans Islamic finance industry to continue growth trajectory over medium term. The prime difference between Islamic bankingfinance and conventional banking is the prohibition of interest. The establishment of Islamic financial institutions is a major step in addressing this predicament as Islamic finance has been characterized as a body to remove exploitation and injustice.

The data in the Economic Outlook 2021 report published by the Finance Ministry MoF shows that the Islamic banking industry in Malaysia has expanded with. Chapter 10 Legal Issues in Sharīʿah-compliant Home Financing in Malaysia. The government of Malaysia sees this as an opportunity for Malaysia to play the major role to be the provider and center of Islamic Finance.

A Case Study of a Bai Bithaman Ājil Contract Umar A. The findings recognised shariah compliancy interest rates as a benchmark and a lack of shariah scholars are the most pertinent current issues for Islamic banks in Malaysia. Almost two-thirds of banks Islamic financing portfolio in Malaysia is conjugated with the household sector holding a debt-to-GDP ratio at 884 percent.

The Global Conference on Islamic Economics and Finance will be the much-needed platform for such discussions and exchange of ideas on the role of Islamic Finance in contributing towards the SDGs. A modern approach for creating a waqf market 7802. Conventional financiers also offer a wide range of investment options in businesses dealing with goods and services that are considered sinful haram.

The issue of riba or usury has long been a problem for Muslims. As the majority of the 18 billion global Muslim population live outside the GCC countries and Malaysia we see high growth potential for the global Islamic finance industry. A comprehensive market infrastructure and a robust and progressive regulatory framework are already in place.

The Malaysia Banking and Financial Act 1989s statement No person shall carry on banking services including receiving deposits on current account deposit account savings account or no other similar account without a license as a bank or financial institutions McGuire et al. There have been listings of sukuk on local exchanges. It is pertinent to mention that myriad Islamic fintech.

Specifically it investigates the practice of Islamic banks in Malaysia in dealing with funds that originate from unlawful sources such as accepting deposits for safe-keeping and investment and providing financial facilities to customers whose incomes come. Integrating waqf crowdfunding into the blockchain. The Paradox Within 7096.

Issues in Islamic banking and finance. The Islamic banking industry in Malaysia is paving the way for a new phase of development. Malaysia is top of international Islamic Finance with the most advanced and.

There are more than 15 billion Muslims all over the world and it is estimated that right around one of every four individuals on the planet rehearses Islam. Islamic banks Shariah-compliant investment and sukuk 16309. Oseni Mohd Fairullazi Ayob and Khairuddin Abdul Rashid 171 Chapter 11 Procedural Laws Governing Event of Default in Islamic Financing in Malaysia.

Maqasid al-Shariah and the legality of Islamic financial contracts 17483. Realising the need to explore new opportunities to bring Islamic finance to the next level Malaysia has recently introduced value-based intermediation VBI principles. However further details were only revealed and then.

From a historical perspective Islamic economic institutions have not been conducive to capital accumulation in Muslim societies Kuran 2004 2011. The concepts of Islamic finance were initially discussed in the mid 1940s. Build Your Own Report.

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

Pin On Islamic Inspirational Quotes

Ethical Considerations In Qualitative Study Study Site Ethics Study

Pdf The Intention To Use Islamic Banking An Exploratory Study To Measure Islamic Financial Literacy

Pdf Islamic Bank Contribution To Indonesian Economic Growth

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Pdf Why Non Muslims Subscribe To Islamic Banking

Reality Of Islamic Finance Any Difference Finance Accreditation Agency Faa 1012469 W

What Is Islamic Finance And What Can It Do Decision Sciences Institute

The Growing Global Appeal Of Islamic Finance

Pdf Islamic Banking Revolution In Malaysia A Review

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Pdf Measuring The Performance Of Islamic Banks In Saudi Arabia

Pdf Why Islamic Banks Tend To Avoid Participatory Financing A Demand Regulation And Uncertainty Framework